Federal Reserve still anticipates three rate cuts in 2024

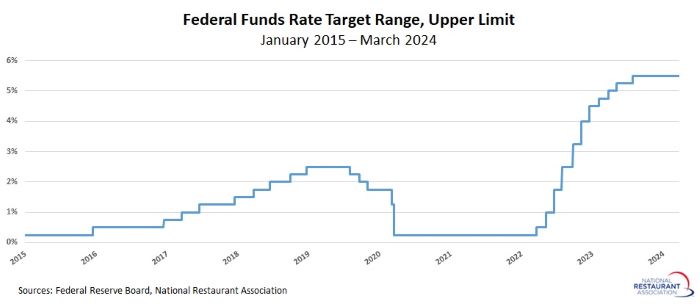

The Federal Open Market Committee left short-term interest rates unchanged at the conclusion of its March 19–20 meeting, as expected. The federal funds rate will remain in the range of 5.25% to 5.50%, continuing to be the highest since 2002. The Federal Reserve noted “solid” economic growth, “strong” job gains and easing (but still elevated) inflationary pressures.

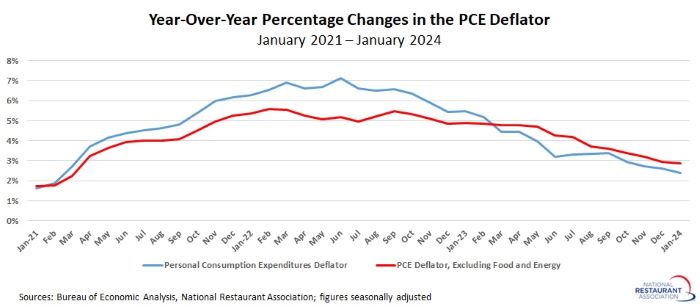

At the same time, the FOMC reaffirmed its long-term goal of achieving core inflation at 2%. Below this threshold would signify in participants’ minds that the economy is growing too slowly, or vice versa with growth above that rate. With that as context, the FOMC statement noted, “The committee does not expect it will be appropriate to reduce the target [federal funds] range until it has gained greater confidence that inflation is moving sustainably toward 2%.” This is the same comment made at its previous meeting on January 30–31.

In economic projections, participants continued to signal three rate cuts this year, the same pace as indicated at its December 12–13 meeting. This would bring the federal funds rate down to 4.50% to 4.75%. FOMC respondents forecast 2.1% and 2.0% growth in 2024 and 2025, respectively, with the outlook for this year improving from December’s estimate of 1.4% growth. The unemployment rate should edge up to 4.0% this year, with 4.1% next year. Those would still be solid readings, remaining not far from “full employment.” Core PCE inflation was seen declining to 2.6% by year’s end in 2024, or 2.2% by the end of 2025, moving closer to the Fed’s target of long-term core inflation being 2%.

The Federal Reserve is eager to stay vigilant when it comes to inflation in the U.S. economy, even with progress in terms of pricing pressures. Recent data, for instance, suggest that costs remain “sticky,” particularly for some items. The core personal consumption expenditures deflator—the Fed’s preferred measure of inflation—had growth 2.9% over the past 12 months in January. While this represented a significant improvement since peaking at 5.6% year-over-year two years ago, the path to the Fed’s 2% target will remain slower than desired.

Still, there continues to be a bias toward reducing rates this year—particularly given the desire to navigate a “soft landing.” It is unlikely that the FOMC will start its rate cuts until the June 11–12 meeting at the soonest, skipping the next one on April 30–May 1, with two additional decreases later in the year.

Read more analysis and commentary from the Association's economists, including the latest outlook for consumers and the economy.