Research

April 23, 2025

For Restaurants and Other Businesses, Demographics Will Remain a Challenge

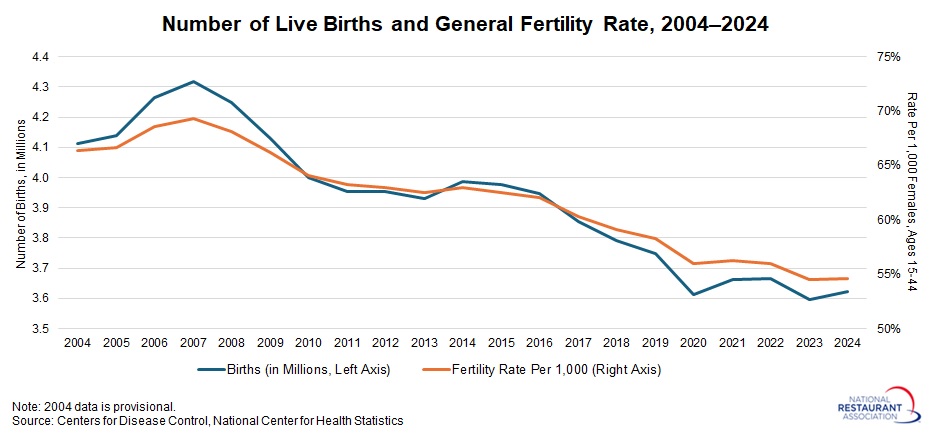

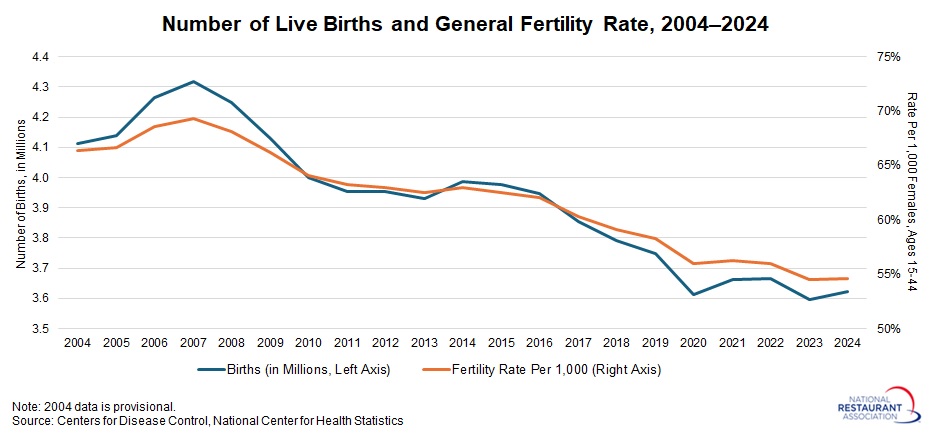

The Centers for Disease Control (CDC) released provisional data on the number of births for 2024. After hitting a record low in 2023, the general fertility rate—or the number of births per 1,000 women aged 15 to 44—rose 0.7% in 2024. An estimated 3,622,673 births were recorded in 2024, up from 3,596,017 in 2023. For context, there were 4.1 million births in 2004, when the fertility rate stood at 66.1%.

The total fertility rate—which reflects the average number of children a woman is expected to have over her lifetime—also ticked up, rising 0.6% from 1.6165 in 2023 to 1.6265 in 2024.

However, as the CDC notes, the total fertility rate remains well below the replacement level of 2.1, or the threshold at which a generation can sustain its population. This underscores why demographic trends will pose long-term challenges for the U.S. in the years ahead.

The Congressional Budget Office echoed this concern in its January population projections. It expects deaths to outpace births by 2033, meaning population growth beyond that point will rely entirely on immigration. Without it, the U.S. population would begin to decline.

These demographic trends carry significant implications. A smaller pipeline of working-age adults suggests the labor force will remain constrained in the years ahead—slowing economic growth and contributing to persistent labor shortages. In fact, the number of job openings has exceeded the number of job seekers since 2018, a structural challenge that shows no signs of easing.

For restaurants, this means hiring will remain difficult, and with a tight labor market, wage growth is likely to stay elevated. Operators will continue looking for ways to boost productivity through technology and operational efficiencies.

At the same time, a slower-growing population dampens long-term demand for goods and services—from restaurant traffic to retail expansion. An aging population will also shift consumption patterns, likely influencing menu design and dining preferences.

Finally, demographic pressures will weigh on government budgets. As spending on healthcare and entitlement programs rises, a smaller base of younger taxpayers will be left to support it—posing long-term fiscal challenges.

Against this backdrop, it’s no surprise that policymakers are exploring ways to reverse current trends, including efforts to boost the birth rate. Whether such initiatives can meaningfully alter the expected decline in population growth over the next decade remains to be seen.

The total fertility rate—which reflects the average number of children a woman is expected to have over her lifetime—also ticked up, rising 0.6% from 1.6165 in 2023 to 1.6265 in 2024.

However, as the CDC notes, the total fertility rate remains well below the replacement level of 2.1, or the threshold at which a generation can sustain its population. This underscores why demographic trends will pose long-term challenges for the U.S. in the years ahead.

The Congressional Budget Office echoed this concern in its January population projections. It expects deaths to outpace births by 2033, meaning population growth beyond that point will rely entirely on immigration. Without it, the U.S. population would begin to decline.

These demographic trends carry significant implications. A smaller pipeline of working-age adults suggests the labor force will remain constrained in the years ahead—slowing economic growth and contributing to persistent labor shortages. In fact, the number of job openings has exceeded the number of job seekers since 2018, a structural challenge that shows no signs of easing.

For restaurants, this means hiring will remain difficult, and with a tight labor market, wage growth is likely to stay elevated. Operators will continue looking for ways to boost productivity through technology and operational efficiencies.

At the same time, a slower-growing population dampens long-term demand for goods and services—from restaurant traffic to retail expansion. An aging population will also shift consumption patterns, likely influencing menu design and dining preferences.

Finally, demographic pressures will weigh on government budgets. As spending on healthcare and entitlement programs rises, a smaller base of younger taxpayers will be left to support it—posing long-term fiscal challenges.

Against this backdrop, it’s no surprise that policymakers are exploring ways to reverse current trends, including efforts to boost the birth rate. Whether such initiatives can meaningfully alter the expected decline in population growth over the next decade remains to be seen.

-

Research

Softer tourism spending is making business conditions more challenging for restaurants

November 14, 2025Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants. -

Research

Average Family Health Insurance Costs Soared to Nearly $27,000 in 2025

October 22, 2025The average health insurance plan for a family of four cost $26,993 in 2025, up 6% from 2024, according to the Kaiser Family Foundation’s latest annual survey. -

Research

Higher volume restaurants reported lower food-cost ratios in 2024

October 16, 2025Lower costs flowed through to the bottom line in the form of higher profitability.