Research

November 14, 2025

Softer tourism spending is making business conditions more challenging for restaurants

Travel and tourism typically accounts for 3 in 10 dollars spent at U.S. restaurants.

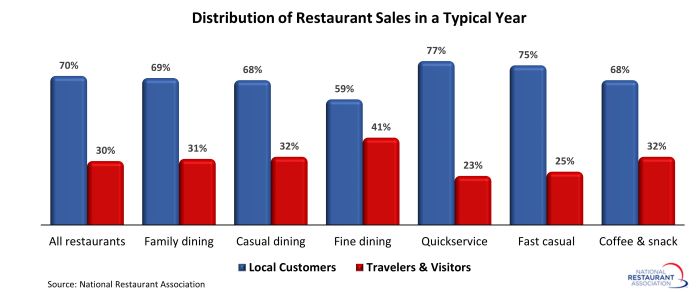

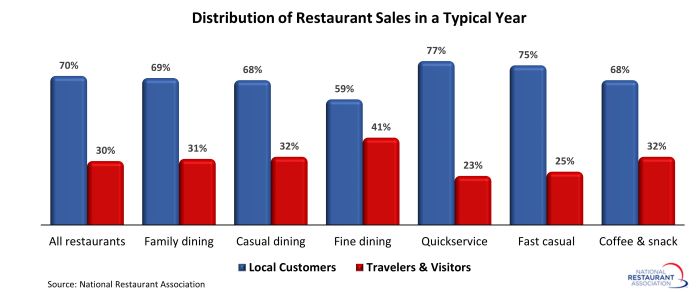

In a typical year, 3 out of every 10 dollars spent at U.S. restaurants comes from travelers and visitors, according to National Restaurant Association research. While this varies significantly by segment and region of the country, virtually all restaurants derive at least some of their sales from customers who live outside of their area.

The reliance on tourism is highest in the fine dining segment, with an average of 41% of sales coming from travelers and visitors. For some fine dining restaurants, it is a significantly larger proportion: 1 in 4 fine dining operators say visitors account for at least 60% of their annual sales.

In the family dining, casual dining and coffee-and-snack segments, roughly one-third of sales come from travelers and visitors. Travelers and visitors account for 1 in 4 dollars spent in the quickservice and fast casual segments.

A majority of restaurant operators say overall business conditions deteriorated in 2025, which marks a significant setback from the industry’s pandemic recovery. Customer traffic declined for nearly two-thirds of restaurants in 2025, while elevated costs continued to stress the bottom line.

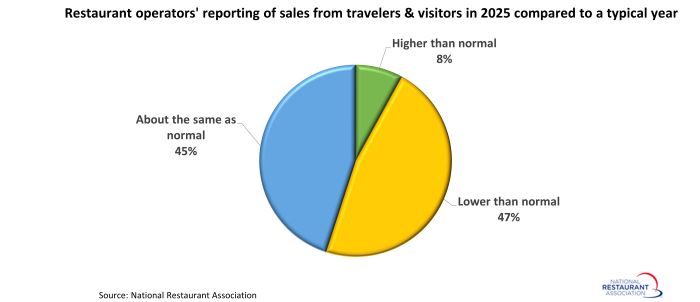

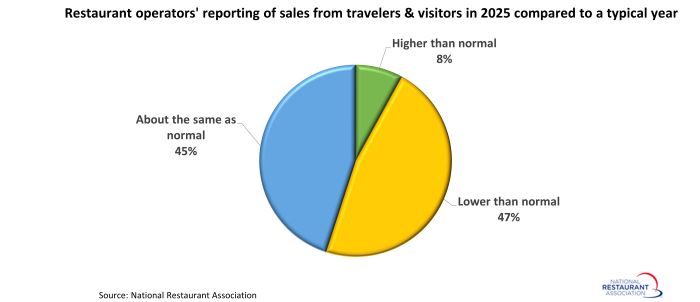

Exacerbating the challenges was a decline in travel and tourism sales. 47% of operators say their sales from travelers and visitors in 2025 are lower than they would normally be in a typical year. Only 8% of operators say their tourism-related sales are higher, while 45% say they are about the same as normal.

A rebound in spending by travelers and visitors would provide a much-needed boost to the business environment for restaurants as the calendar flips to 2026.

The reliance on tourism is highest in the fine dining segment, with an average of 41% of sales coming from travelers and visitors. For some fine dining restaurants, it is a significantly larger proportion: 1 in 4 fine dining operators say visitors account for at least 60% of their annual sales.

In the family dining, casual dining and coffee-and-snack segments, roughly one-third of sales come from travelers and visitors. Travelers and visitors account for 1 in 4 dollars spent in the quickservice and fast casual segments.

A majority of restaurant operators say overall business conditions deteriorated in 2025, which marks a significant setback from the industry’s pandemic recovery. Customer traffic declined for nearly two-thirds of restaurants in 2025, while elevated costs continued to stress the bottom line.

Exacerbating the challenges was a decline in travel and tourism sales. 47% of operators say their sales from travelers and visitors in 2025 are lower than they would normally be in a typical year. Only 8% of operators say their tourism-related sales are higher, while 45% say they are about the same as normal.

A rebound in spending by travelers and visitors would provide a much-needed boost to the business environment for restaurants as the calendar flips to 2026.