Restaurant Performance Index rose 0.3% in February

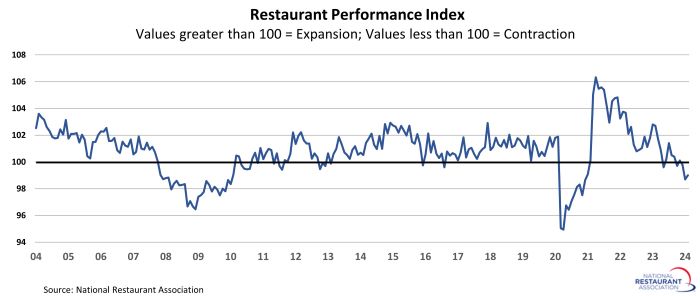

The National Restaurant Association’s Restaurant Performance Index (RPI) remained below 100 in contraction territory in February, as dampened sales and traffic combined with a mixed outlook for sales. The RPI – a monthly composite index that tracks the health of the U.S. restaurant industry – stood at 99.0 in February, up 0.3% from a level of 98.7 in February.

Restaurant operators reported a modest improvement in same-store sales and customer traffic from January’s soft readings, but both metrics were still down from year-ago levels. Looking forward, restaurant operators’ outlook for both sales and the economy in the months ahead remains uncertain.

The Current Situation Index, which measures current trends in four industry indicators, stood at 98.3 in February – up 1.8% from a level of 96.6 in January. February represented the fifth consecutive month in which the Current Situation Index stood below the 100 level in contraction territory.

The Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators, stood at 99.7 – down 1.1% from a level of 100.8 last month. Restaurant operators have a mixed outlook for sales in the months ahead, and they are even less optimistic about the direction of the economy.

RPI Methodology

The National Restaurant Association's Restaurant Performance Index (RPI) is a monthly composite index that tracks the health of the U.S. restaurant industry. Launched in 2002, the RPI is released on the last business day of each month.

The RPI is measured in relation to a neutral level of 100. Index values above 100 indicate that key industry indicators are in a period of expansion, while index values below 100 represent a period of contraction for key industry indicators. The Index consists of two components — the Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), and the Expectations Index, which measures restaurant operators’ six-month outlook for four industry indicators (same-store sales, employees, capital expenditures and business conditions).

The RPI is based on the responses to the National Restaurant Association’s Restaurant Industry Tracking Survey, which is fielded monthly among restaurant operators nationwide on a variety of indicators including sales, traffic, labor and capital expenditures. Restaurant operators interested in participating in the tracking survey: contact Bruce Grindy.

For more detailed analysis of the RPI and Industry Tracking Survey data, see Restaurant TrendMapper.

Updated 3/29/2024