Research

January 22, 2026

GDP

U.S. Economy Grew Solidly in Q3 Despite Consumer and Business Jitters

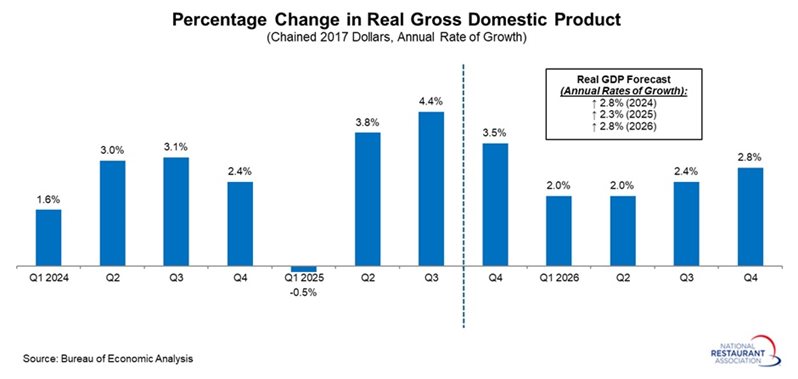

The U.S. economy expanded at a strong 4.4% annual rate in the third quarter of 2025, according to revised data and continuing to be delayed by the government shutdown. This marks the fastest pace of growth since Q3 2023 and builds on the solid 3.8% gain in the second quarter, following a 0.5% contraction earlier in the year.

While real GDP has been somewhat “noisy” in 2025—driven in part by trade volatility—both consumers and businesses have grown more cautious. Even so, the economy has shown notable resilience, with back‑to‑back robust output readings in Q2 and Q3. Beneath the headline figures, however, concerns remain. Business investment softened, suggesting hesitancy on the part of firms, and consumer spending patterns point to increased selectivity. This mirrors what we hear from restaurant operators and consumers.

Looking ahead, the National Restaurant Association expects continued growth, with real GDP projected to rise 2.3% in 2025 and 2.8% in 2026—a forecast that reflects steady momentum despite persistent downside risks.

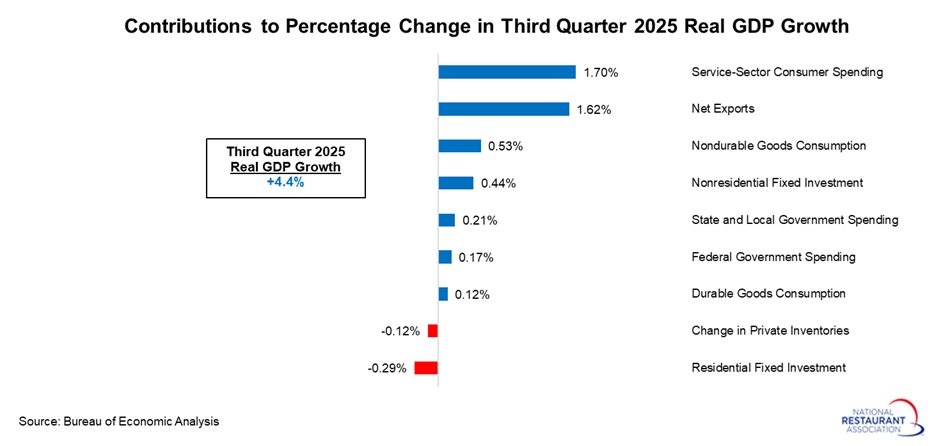

Consumer spending remained a bright spot, especially in services and nondurable goods. Personal consumption expenditures rose at a 3.5% annual rate—the strongest pace since late last year—and contributed 2.34 percentage points to overall GDP growth. Even so, spending at foodservices and accommodations added just 0.06 percentage points, down from a 0.28‑point contribution in the second quarter.

Investment activity improved but was a slight drag on growth. Fixed investment slowed from a 4.4% annualized gain in Q2 to just 0.8% in Q3, with nonresidential fixed investment easing from 7.3% to 3.2%. Equipment (+5.2%) and intellectual property investment (+5.6%) both held up well, but structures spending (-5.0%) declined for the seventh consecutive quarter. Meanwhile, residential investment (-7.1%) fell for the third straight quarter, and businesses continued to draw down inventories for the second quarter in a row.

Net exports added 1.62 percentage points to real GDP in the third quarter, making it the second‑largest contributor after service-sector spending. This boost primarily reflected a sharp drop in imports, which fell 4.4% at an annual rate. Exports strengthened, rising 9.6% in the quarter.

Government spending contributed an additional 0.38 percentage points to headline growth. Federal outlays increased 2.7% in Q3 after notable declines in the first half of the year, driven largely by higher national defense spending. Nondefense outlays fell for the third consecutive quarter. Meanwhile, state and local government spending also moderated, easing from a 3.1% gain in Q2 to 2.0% in Q3.

While real GDP has been somewhat “noisy” in 2025—driven in part by trade volatility—both consumers and businesses have grown more cautious. Even so, the economy has shown notable resilience, with back‑to‑back robust output readings in Q2 and Q3. Beneath the headline figures, however, concerns remain. Business investment softened, suggesting hesitancy on the part of firms, and consumer spending patterns point to increased selectivity. This mirrors what we hear from restaurant operators and consumers.

Looking ahead, the National Restaurant Association expects continued growth, with real GDP projected to rise 2.3% in 2025 and 2.8% in 2026—a forecast that reflects steady momentum despite persistent downside risks.

Consumer spending remained a bright spot, especially in services and nondurable goods. Personal consumption expenditures rose at a 3.5% annual rate—the strongest pace since late last year—and contributed 2.34 percentage points to overall GDP growth. Even so, spending at foodservices and accommodations added just 0.06 percentage points, down from a 0.28‑point contribution in the second quarter.

Investment activity improved but was a slight drag on growth. Fixed investment slowed from a 4.4% annualized gain in Q2 to just 0.8% in Q3, with nonresidential fixed investment easing from 7.3% to 3.2%. Equipment (+5.2%) and intellectual property investment (+5.6%) both held up well, but structures spending (-5.0%) declined for the seventh consecutive quarter. Meanwhile, residential investment (-7.1%) fell for the third straight quarter, and businesses continued to draw down inventories for the second quarter in a row.

Net exports added 1.62 percentage points to real GDP in the third quarter, making it the second‑largest contributor after service-sector spending. This boost primarily reflected a sharp drop in imports, which fell 4.4% at an annual rate. Exports strengthened, rising 9.6% in the quarter.

Government spending contributed an additional 0.38 percentage points to headline growth. Federal outlays increased 2.7% in Q3 after notable declines in the first half of the year, driven largely by higher national defense spending. Nondefense outlays fell for the third consecutive quarter. Meanwhile, state and local government spending also moderated, easing from a 3.1% gain in Q2 to 2.0% in Q3.

.jpg?lang=en-US)