Research

January 28, 2026

Monetary Policy

Federal Reserve leaves interest rates unchanged

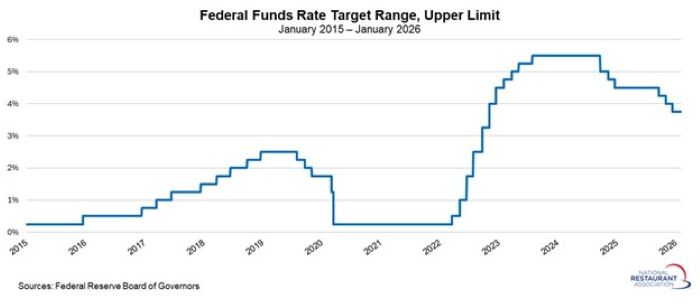

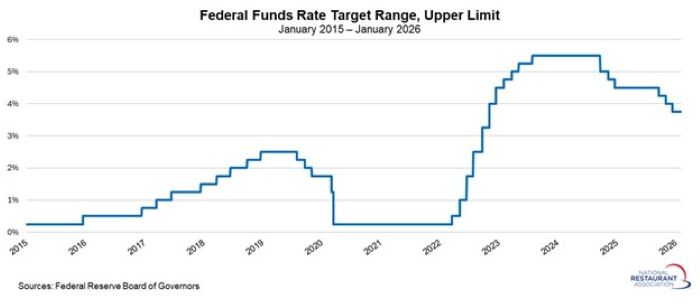

The Federal Open Market Committee (FOMC) kept short‑term interest rates unchanged at its January 27–28 meeting, following three consecutive 25‑basis‑point cuts. The federal funds rate remains in a target range of 3.50% to 3.75%.

The Committee reaffirmed its view that 2 percent inflation, measured by the PCE deflator, is most consistent with its dual mandate of maximum employment and price stability. This will continue to guide monetary policy decisions.

FOMC participants noted that the U.S. economy is expanding at a solid pace and that inflation remains elevated. Although job growth has softened, “the unemployment rate has shown some signs of stabilization.” For now, concerns over lingering inflationary pressures outweigh labor‑market worries.

Two members—Stephen I. Miran and Christopher J. Waller—dissented, preferring an additional 25‑basis‑point rate cut.

Looking ahead, officials emphasized that future rate reductions will depend on incoming data, the economic outlook, and the balance of risks, including labor market conditions, inflation dynamics, and global developments. While markets expect the FOMC to lower rates later this year, the timing remains uncertain and will hinge on evidence of cooling economic activity in the months ahead. This could occur at one of the next two meetings, March 17–18 or April 28–29, but the odds might be higher for later in the year.

For the restaurant industry, elevated interest rates continue to weigh on borrowing costs, delaying expansion plans and capital investments. A lower rate environment could help ease credit burdens, bolster consumer spending, and support demand in sectors sensitive to discretionary income, including foodservice and hospitality.

The Committee reaffirmed its view that 2 percent inflation, measured by the PCE deflator, is most consistent with its dual mandate of maximum employment and price stability. This will continue to guide monetary policy decisions.

FOMC participants noted that the U.S. economy is expanding at a solid pace and that inflation remains elevated. Although job growth has softened, “the unemployment rate has shown some signs of stabilization.” For now, concerns over lingering inflationary pressures outweigh labor‑market worries.

Two members—Stephen I. Miran and Christopher J. Waller—dissented, preferring an additional 25‑basis‑point rate cut.

Looking ahead, officials emphasized that future rate reductions will depend on incoming data, the economic outlook, and the balance of risks, including labor market conditions, inflation dynamics, and global developments. While markets expect the FOMC to lower rates later this year, the timing remains uncertain and will hinge on evidence of cooling economic activity in the months ahead. This could occur at one of the next two meetings, March 17–18 or April 28–29, but the odds might be higher for later in the year.

For the restaurant industry, elevated interest rates continue to weigh on borrowing costs, delaying expansion plans and capital investments. A lower rate environment could help ease credit burdens, bolster consumer spending, and support demand in sectors sensitive to discretionary income, including foodservice and hospitality.