Research

February 10, 2026

Total restaurant industry sales

Restaurant sales edged down 0.1% in December

Restaurant sales leveled off in December, as consumers took a pause from their recent spending gains.

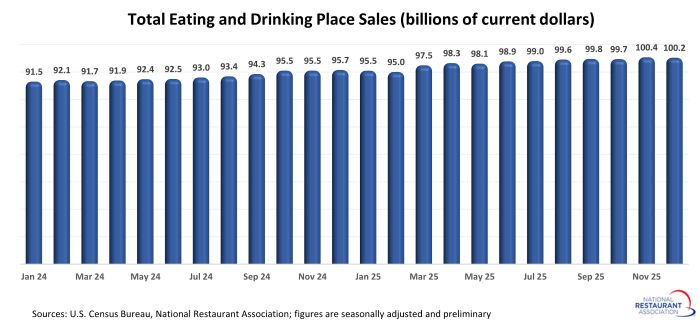

Eating and drinking places registered total sales of $100.2 billion on a seasonally adjusted basis in December, according to preliminary data from the U.S. Census Bureau. That was down slightly from November’s sales volume of $100.4 billion.

December’s modest decline came on the heels of a solid 0.7% increase in November – the strongest monthly gain since June (+0.8%). Despite the downtick in December, total eating and drinking place sales topped $300 billion in the fourth quarter of 2025. That was up 0.7% from the third quarter’s sales volume, and represented the first quarter on record with sales above the $300 billion level.

Consumer spending was also relatively muted in other sectors in December. Sales at non-restaurant retailers were flat in December, with only building material and supply stores (+1.2%) and sporting goods and hobby stores (+0.4%) registering notable gains. Spending at home furnishing stores (-0.9%), clothing stores (-0.7%) and department stores (-0.7%) fell sharply, while sales at non-store retailers (+0.1%) were essentially unchanged.

While the trendline wobbled a bit in the fourth quarter, restaurant sales growth outperformed the overall retail sector during much of 2025. Eating and drinking place sales stood 4.7% above their year-ago level in December, which was more than double the 2.1% increase in non-restaurant retail sales during the 12-month period.

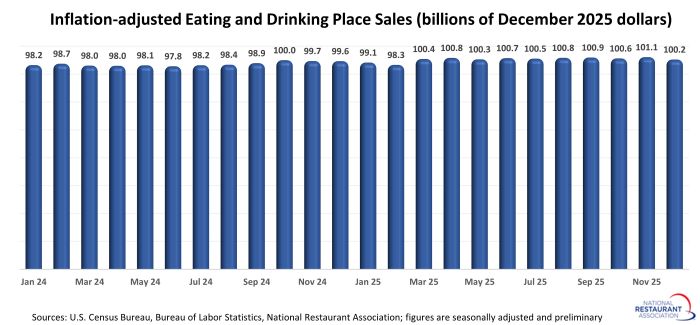

However, as in recent years, rising menu prices drove much of the sales growth in 2025. After adjusting for menu price inflation, eating and drinking place sales rose just 0.6% between December 2024 and December 2025.

Note: Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry and represent approximately 72% of total restaurant and foodservice sales.

Eating and drinking places registered total sales of $100.2 billion on a seasonally adjusted basis in December, according to preliminary data from the U.S. Census Bureau. That was down slightly from November’s sales volume of $100.4 billion.

December’s modest decline came on the heels of a solid 0.7% increase in November – the strongest monthly gain since June (+0.8%). Despite the downtick in December, total eating and drinking place sales topped $300 billion in the fourth quarter of 2025. That was up 0.7% from the third quarter’s sales volume, and represented the first quarter on record with sales above the $300 billion level.

Consumer spending was also relatively muted in other sectors in December. Sales at non-restaurant retailers were flat in December, with only building material and supply stores (+1.2%) and sporting goods and hobby stores (+0.4%) registering notable gains. Spending at home furnishing stores (-0.9%), clothing stores (-0.7%) and department stores (-0.7%) fell sharply, while sales at non-store retailers (+0.1%) were essentially unchanged.

While the trendline wobbled a bit in the fourth quarter, restaurant sales growth outperformed the overall retail sector during much of 2025. Eating and drinking place sales stood 4.7% above their year-ago level in December, which was more than double the 2.1% increase in non-restaurant retail sales during the 12-month period.

However, as in recent years, rising menu prices drove much of the sales growth in 2025. After adjusting for menu price inflation, eating and drinking place sales rose just 0.6% between December 2024 and December 2025.

Note: Eating and drinking places are the primary component of the U.S. restaurant and foodservice industry and represent approximately 72% of total restaurant and foodservice sales.